- Bitcoin price is falling below the daily support level of $56,000, looking forward.

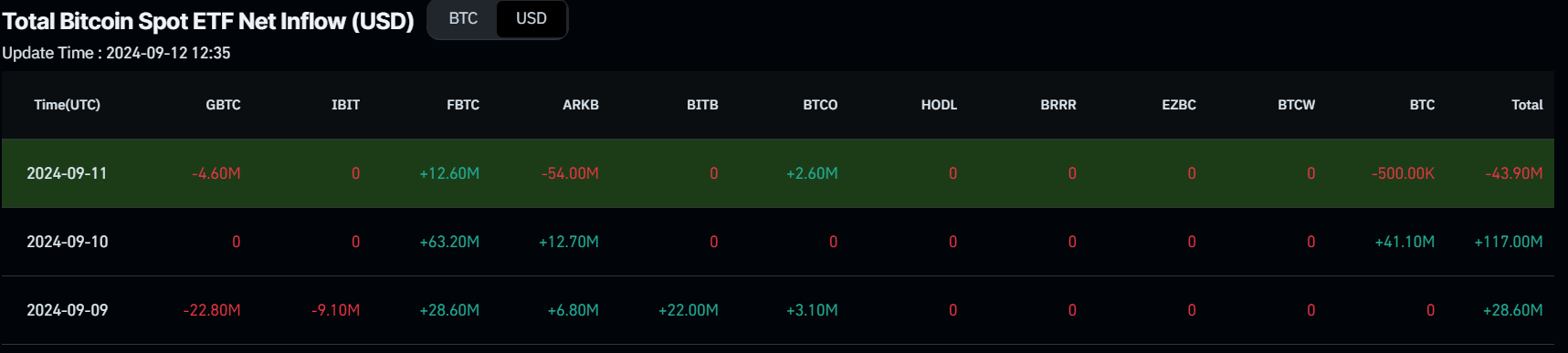

- US Spot ETFs recorded a slight inflow of $43.90 million on Wednesday.

- Technical indicators and data on the chain point to a rally ahead.

Bitcoin (BTC) price rose slightly after finding support around the $58,000 level around the $56,000 level on Thursday, supported by a positive market for risk assets. The recovery comes as US Bitcoin Spot Exchange Traded Funds (ETF) recorded light inflows on Wednesday. On-chain data projects a rise in the price of Bitcoin as its exchange reserves decrease and the long-short ratio trades above one.

Daily Digest Market Movers: US CPI Data Takes Risk

Bitcoin price strengthened after the United States (US) released the Consumer Price Index (CPI) for August. The US Bureau of Labor Statistics reported that the annual CPI rose 2.5% over the previous year, down from 2.9% the previous year. Also, the main annual figures coincide with July 1 and are expected to print 3.2%. However, the actual monthly increase was higher than expected, marking 0.3%.

Data suggested the US Federal Reserve (Fed) will cut interest rates by 25 basis points after its meeting next week, the first cut since 2019.

US Bitcoin Spot Exchange Traded Funds (ETF) data recorded an outflow of $43.90 million on Wednesday, the first outflow so far this week. Still, this flow is less than all of the Bitcoin stocks held by the 11th largest U.S. Bitcoin ETFs, which total $49.34 billion in assets under management (AUM).

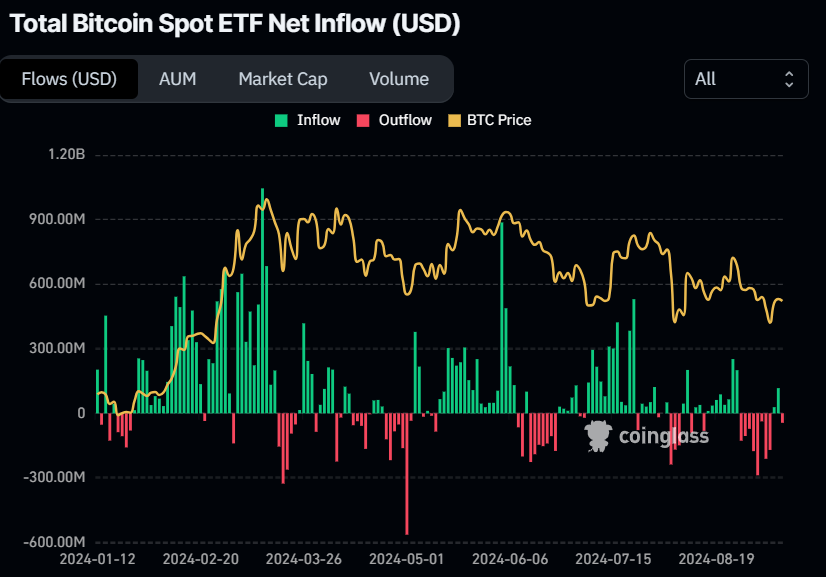

Bitcoin Spot EFT Net Inflow Chart

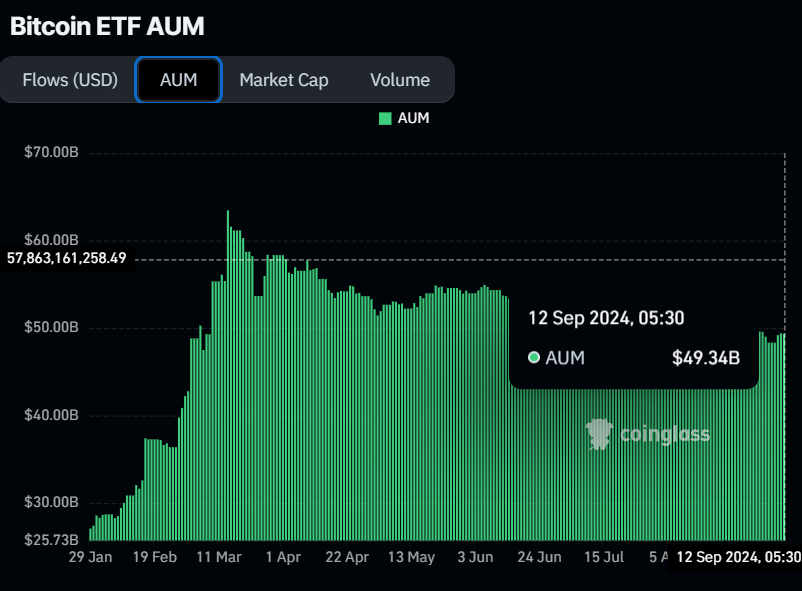

Bitcoin ETF AUM Chart

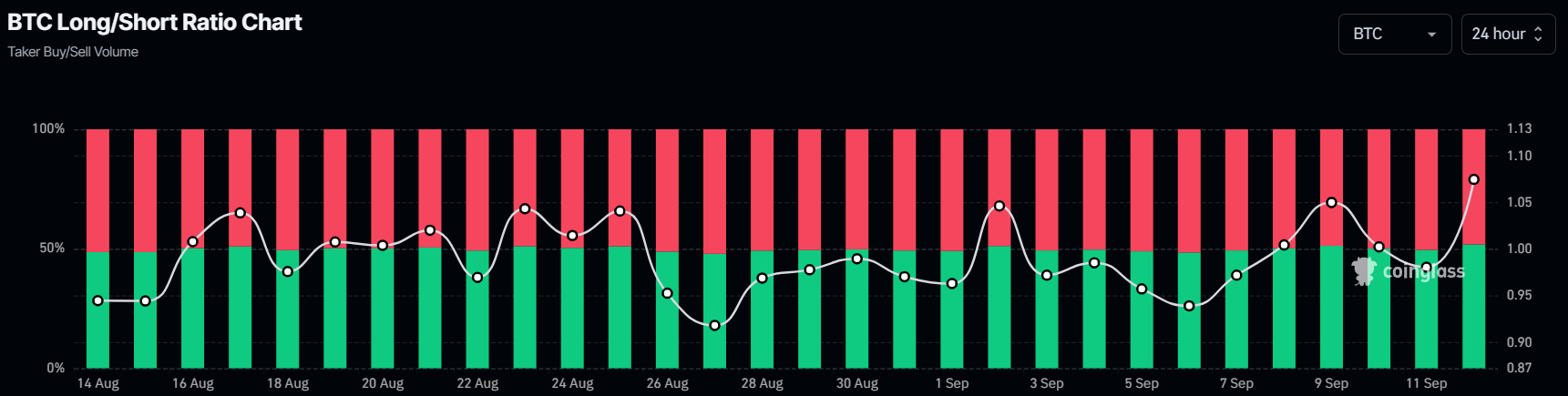

Turning to on-chain metrics, Coinglass BTC’s long-short ratio is at 1.07, the highest level in nearly a month and rising above one on Thursday. This means that more traders are betting on rising asset prices.

Bitcoin long and short ratio chart

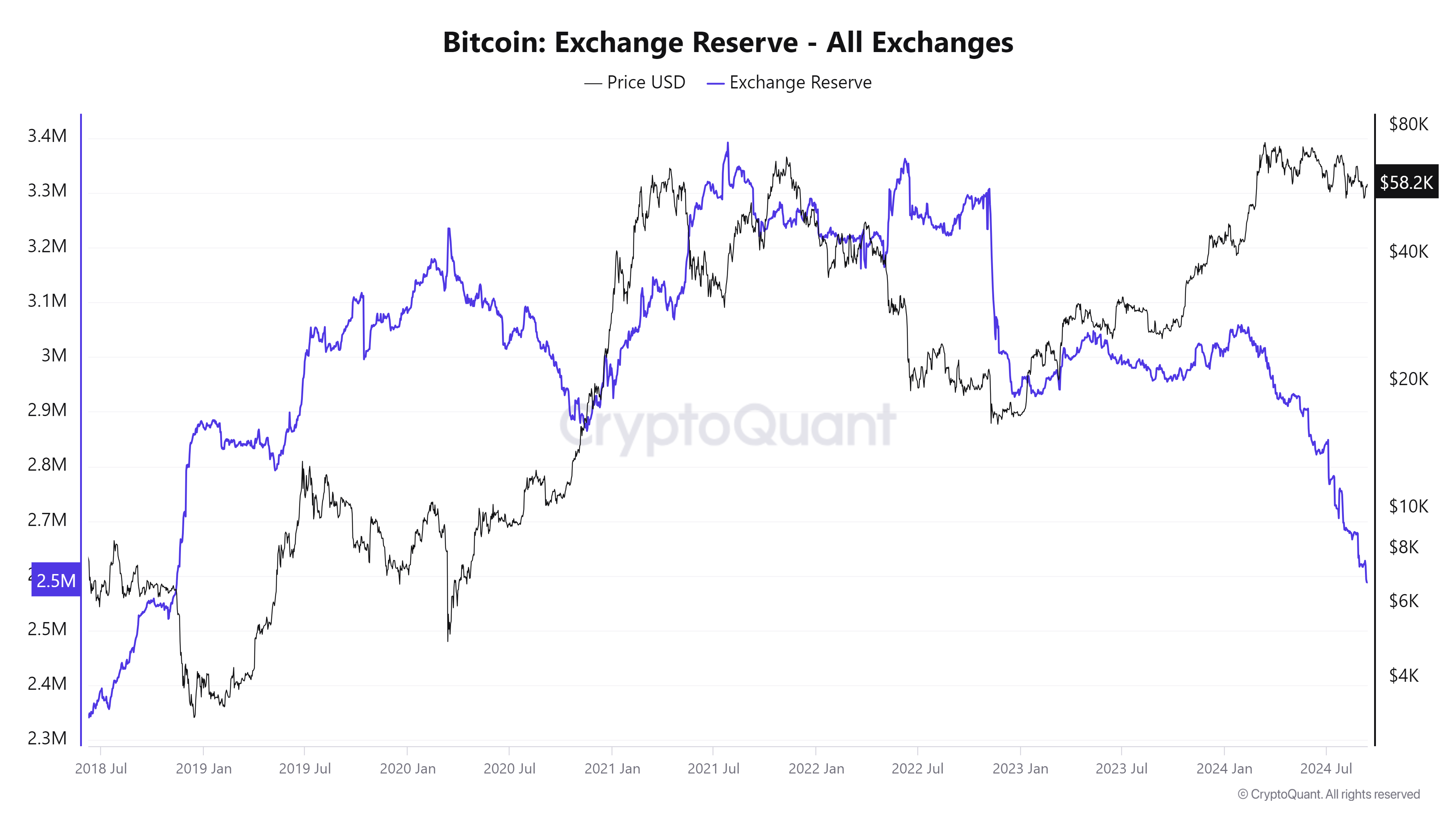

Cryptocurrency exchange stock data is also positive for Bitcoin. The data provides insight into the level of sales pressure accumulated within the exchange. This metric stands at 2.5 million BTC, the lowest level since November 2018, and has been steadily declining since mid-August. The decline in reserves indicates that investors are more willing to withdraw their crypto from exchanges for purposes other than immediate sale, thereby reducing the supply available for trading, reinforcing the bullish outlook for Bitcoin’s price.

Bitcoin Exchange Reserve Chart

Technical Analysis: BTC breaks out of $56,000

Bitcoin price reviewed the $56,022 daily support on Wednesday and bounced back from it. At the time of writing, it continues to rise 1.1% at $57,965 on Thursday.

If $56,022 holds daily support, BTC could continue to rise to a comfortable level of $59,529, the 50% price retracement level (dropped from late July high to early August low).

This increase in Bitcoin price is also supported by the Moving Average Convergent Divergence (MACD) indicator on the daily chart. The MACD line (12-day Exponential Moving Average, blue line) rises above the signal line (26-day Exponential Moving Average, yellow line), giving a buy signal. It shows green histogram bars above the neutral line zero, also suggesting that the asset price may experience an upward movement.

BTC/USDT Daily Chart

However, if Bitcoin closes below the $56,022 level then the biology thesis will be invalidated. In this scenario, BTC could drop another 3.5% to stay above the psychologically important $54,000 level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This type of payment cannot be controlled by any one person, group or institution, which eliminates the need for third party participation during financial transactions.

Altcoins are any cryptocurrency except Bitcoin, but some consider Ethereum to be a non-altcoin because it is one of the two cryptocurrencies to be forked. If this is true, then Litecoin is the first altcoin, built on the Bitcoin protocol and therefore an “optimized” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, their value backed by the underlying asset they represent. To achieve this, the value of each stablecoin is pegged to a commodity or financial instrument, such as the US dollar (USD), whose supply or demand is regulated by an algorithm. The main purpose of stablecoins is to provide an online/off ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value because cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the combined market capitalization of all cryptocurrencies. This gives a clear picture of the interest of Bitcoin among investors. BTC bullishness usually occurs before and during bull runs, in which investors resort to investing in relatively stable and high market capitalization cryptocurrencies such as Bitcoin. A decline in BTC dominance usually means that investors are shifting their capital and/or profits to altcoins in search of higher returns, which usually creates an explosion of altcoin rallies.

#Bitcoin #Eyeing #Technical #Indicators #Point #Fall #Ahead